Discover more from Agent131711’s Substack

Is Investing in Gold a PSYOP? Are Precious Metals Actually a BAD Investment? Is Silver a Scam?

The more I research this, the worse it seems to be. This is going to piss a lot of people off, but at this point, we need to question everything...

A Psychological Operation is a covert military tactic to influence the behaviors of individuals. PSYOPs are operations that convey selected information to a target audience with the goal of getting them to take an action, or develop a belief, that coincides with the operations objective. Here in Detroit, we call this a mindf*ck...

Earlier this year, I shared with you Military Black PSYOP documents that talk about how the media is key to these operations. This isn’t limited to news outlets. Media means magazines, books, products, television shows, commercials / advertisements, even movies (Disney is named in the document as a PSYOP partner!). So, when I start seeing all of the media, on both sides of the aisle, pushing the identical message, such as “Gold is the best investment in history!”, I think to myself, “Hmmm. That’s interesting…”

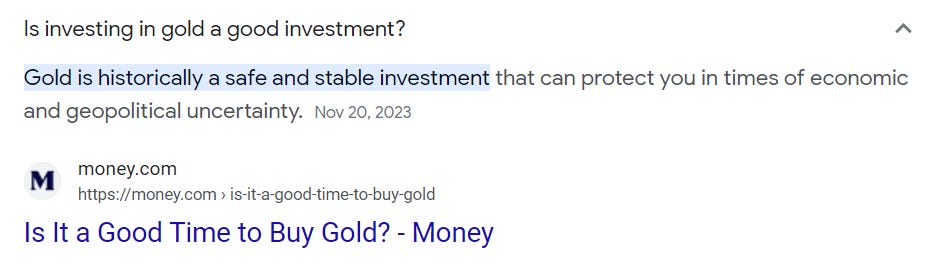

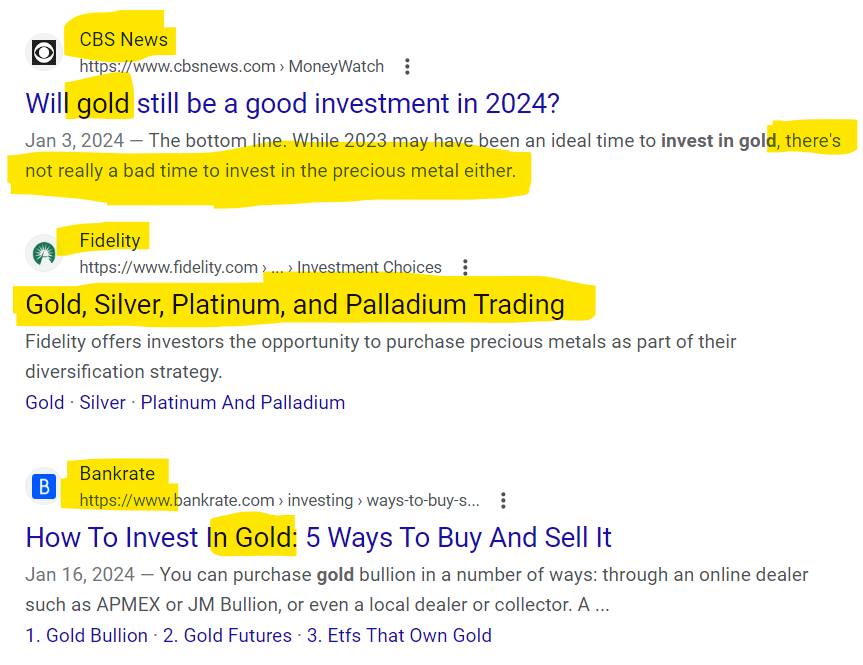

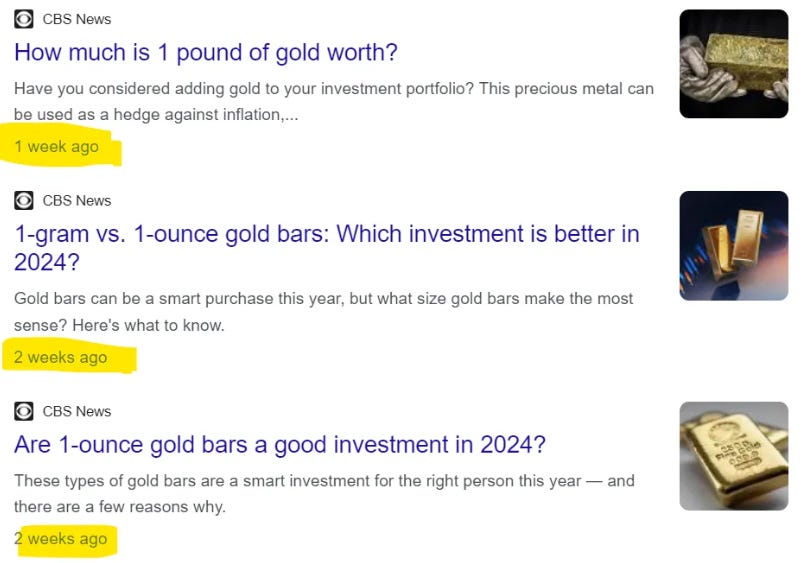

CBS News is pushing hard for people to invest in gold. They are pumping out two-to-three pro-gold articles per week:

CBS doesn’t just say it’s a good investment, they are encouraging you to invest in the near future, or right now:

Yahoo News:

Bloomberg cranks out almost as many gold-is-great articles as CBS:

Gold companies seem to advertise on every Alternative Media show I listen to. Say it with me kids, “Hmmm. That’s interesting…”

AGENDA 2050: A CASHLESS SOCIETY

We know that the evil-doers wet dream is a social credit score system tied to a carbon-usage system, with people living in pods, eating 3D printed bugs (yep, you read that correctly. They want to 3D print the bugs. I found the menu. I will be sharing it with you soon), being surveilled every moment of every hour of every day and us plebs owning nothing.

Although owning nothing is a pillar of Agenda 2050, one of the essential components of this system is being a “cashless society”. The reason this is hugely important is because it gives them complete control over us. Since the money is virtual, it is completely monitored. As I wrote about in The Covid Mask PSYOP: The REAL Reason for Masks is Not What You Think, we will each be assigned a life-long identification number, which will be linked to every action we make, every item we purchase and anything we sell. Every transaction will be reviewed by a ”third party” for our Social Credit Score, so we can be more like China. (thought to self: that song Every Breath You Take by The Police is pretty fitting right about now…)

Here in the USA, they are already foreshadowing the cashless society:

They even use their buzzwords in combination with cashless society. “Inclusion” + “Safeguards” = trap everyone, without discrimination.

This cashless society stuff isn’t just an idea. On October 25, 2021, the Nigerian government launched Africa’s first central bank digital currency called the eNaira, so this is happening. Africa is always the test market. Then, if successful, it happens in Australia, then Canada and the UK simultaneously, then the USA. The reason Africa is chosen is due to the poverty rate. When you own nothing, your Rights are easily taken.

You’re probably thinking, “What does this have to do with gold?” - I’m getting there. Bear with me for another minute.

To reach the cashless stage here in the US, they need to get paper currency out of our hands. Once enough of it has been secured, they can declare it obsolete. Once it is obsolete, it will no longer be of any value. Then, once we are 100% virtual currency, we will be cut off with the flip of a power switch or the push of a deactivate account button. There has even been rumors of our digital currency having expiration dates, thus making it impossible to save, which flows seamlessly into owning nothing. Look how easily they “debanked” people for publishing content that didn’t support The Agendas. When the Canadian Truckers were getting Bitcoin donations, they seized those too, which should sound the alarm for anyone remotely considering Crypto to be safe.

GETTING CURRENCY OUT OF OUR HANDS

There are several ways they have tried to go about securing as much paper currency as possible. One method is exactly what I just mentioned, Crypto Currency, which the World Economic Forum loves. Unless you have been following this Substack for couple months, you might not know that the National Security Agency (NSA) created Bitcoin: (56 second video)

That’s a really f*cking big deal! This is the mother of all “inclusive” TRAPS!

Another idea was offering incentives for people when they pay using credit cards (cash-back programs, airline miles, gasoline discounts, etc). Then they offered perks if you pay using your phone, linked to your card, such as Samsung Pay’s free gift card program. All of this was to get us adjusted to 100% virtual payments and help paper currency go extinct… and it’s working…

Next came other schemes, like NFT’s, which was investing in, quite literally, nothing at all. We were supposed to buy into something virtual that has no tangible existence. Thankfully, most of us were too old to understand the hype surrounding it. Personally, I thought it was the stupidest thing I’ve heard since the phrase, “mostly peaceful protests”, with a city aflame in the background.

Regardless of the angle, the goal is to eliminate paper currency. So, we have to ask, if the ultimate goal is a virtual currency system, in which we own nothing, is investing in gold and silver nothing more than, “you give us your money and we will give you a piece of metal”? Instead of invisible crypto and NFTs, is investing in precious metal actually investing in an expensive paperweight? Something tangible for us to hold because NFT’s and Bitcoin don’t appeal to us?

…And this is where my research began…

THINGS WE DIDN’T KNOW…

Being married for multiple decades, I have figured out that I can buy anything I want, as long as I give it to my spouse as a gift. Over the years, I have scrimped and saved to buy myself my partner all kinds of stuff, including a pet lizard, a big screen television, a couple kilo blocks of silver, a few dozen silver coins and one little, tiny gold coin (because I’m not rich). Oh, and when your spouse looks at you and says, “What am I supposed to do with this?”, while holding up your their new silver coin, just put your best puppy-dog eyes on and reply, in a sad voice, “You don’t like your gift?”. Trust me, it works like a charm. My point is, I bought into this investment opportunity hook, line and sinker, I guess because it was being promoted by people I like, on shows I enjoy… but everything changed when I saw a little video clip…

Here’s the video clip: (11 second video. Link to full, 1-hour presentation is in the Sources section)

Just in case the video doesn’t play for you, “The Rothschild Family Sets the Price of Gold in London”. If that didn’t make you choke on that Slim Jim you’re eating, you need to set the meat stick down and watch it again. I had no idea how the price of gold was set, but I sure as f*ck didn’t think it was that way. Maybe I should also mention, the Rothschilds own gold mines, giving them essentially unlimited gold, which they set the price on. Meaning, it doesn’t matter to them; it’s a game. A game that you and I have to work 120 hours worth of overtime to afford a microscopic metal playing piece in. And also, the Rockefellers have mines too… and the Carnegies… and JP Morgan… did you know Bill Gates and Jeff Bezos share mines? = THEY PRODUCE THE GOLD! WE ARE BUYING THEIR PRODUCT!! If we knew we are buying Rothschilds, Gates, Bezos or Rockefellers gold, would we still invest in it? The answer on my end is, “HELL NO! You can take your metal brick, turn it sideways and jam it down your d*ck hole!”

Let’s summarize this by saying:

PROBLEM #1: The price is set by our mortal enemy and our enemies, quite literally, own the game…

PROBLEM #2: History

We are not allowed to own anything they cannot take. And this, my friends, is a massive problem…

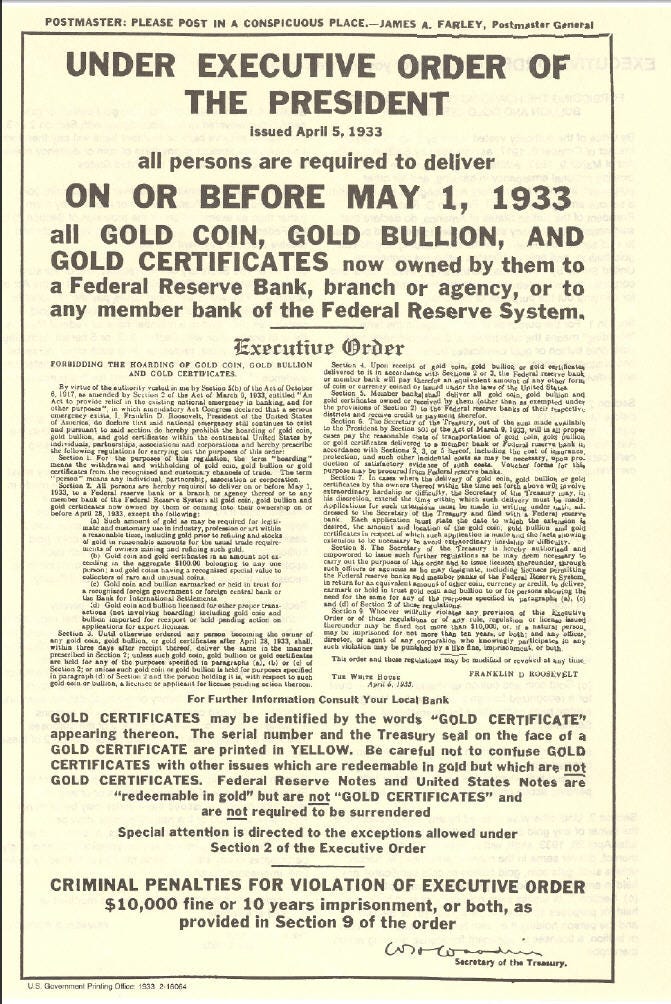

Only 20 years after the Federal Reserve was established, it needed a bailout (LOL, I guess). So, less than 100 years ago, the good government decided to steal from its citizens to cover the (alleged) bailout costs:

Only a couple years after the infamous Stock Market Crash of 1929, Executive Order 6102 was signed on April 5, 1933, by President Franklin D. Roosevelt (a Master Freemason), "forbidding the hoarding of gold coin and gold bullion within the continental United States”. Btw, “hoarding” meant owning. Yes, the government decided we cannot have a natural resource, (but Rockefeller and the elites could have their mines)…

Additionally, the Executive Order made US Treasury Gold Certificates no longer legal tender when held by the general public (meaning us plebs, or as I call us, “the general pleblic”). This meant our gold certificates, that we worked 120 hours of overtime and scrimped and saved for, then gave to our spouse as a gift, are literally worthless, unless we exchanged them at the US Treasury or Federal Reserve Bank for non-gold paper (standard paper currency), which, some reports say were taxed as high as 50%!

As if that wasn’t bad enough, the following year, on August 9, 1934, President Franklin D. Roosevelt implemented the seizure of all silver in the continental United States through Executive Order 6814.

After the precious metals were rounded-up, the United States of America was taken off The Gold Standard, meaning the paper currency people were forced to get was backed by absolutely nothing, it might as well have been NFTs.

Next, gold ownership was made illegal, and remained illegal in the US until the 1970s! FOURTY F*CKING YEARS! The people of that time had worthless stock, worthless gold certificates, and worthless illegal gold and silver… Roosevelt would go on to be reported in history as the most beloved president of all time:

Fun Fact: Beloved President Roosevelt was also who signed into action the first biological weapons program. We will be discussing this insanity in my next post, and trust me, you don’t want to miss it. Want a teaser?: MERCK. (Yes, that Merck)

This precious-metal-government-craziness-scheme wasn’t just in the USA. In 1998, the United Kingdom announced plans to start selling off the country’s gold supply, “sending prices tumbling to a 20-year low”. (But, no worries. Rocky, Roth’s and Billy-Boy-Big-Titties-Gates can dig more out of their mines at any time… and speaking of that, who exactly was buying up all of the gold? Nobody knows… ) (And also, Gates is at least a B-Cup. Possibly a soft C. It’s gotta be the Soy.)

The following year, fears that other central banks will start selling off their gold reserves pushed prices down further. People rushed to dump their investments, even if it meant taking a loss, with the hopes of avoiding complete financial devastation.

Then, something amazing happened…

Only two years after the mass sell-off, who would have ever guessed that on September 12, 2001, the day after the 9/11 terrorist attacks, the price of gold would magically leap up to $287 an ounce? This just might be a brilliant way to pay your friends who helped you in the scheme without writing a single check or hauling a briefcase full of cash into a dark alley. 100% traceless bribery.

Do you want to hear something interesting that I stumbled across while researching? Iraq has the same price-per-ounce of gold as the USA, so when these prices magically jumped up, it also paid Iraq. Is this who was actually meant to be paid? Because we know 9/11 sure as hell didn’t happen as we are told it did. And speaking of that, do you remember how George Bush was a hero for the confiscation of evil Iraq’s gold in 2003? The photos proved it, right?

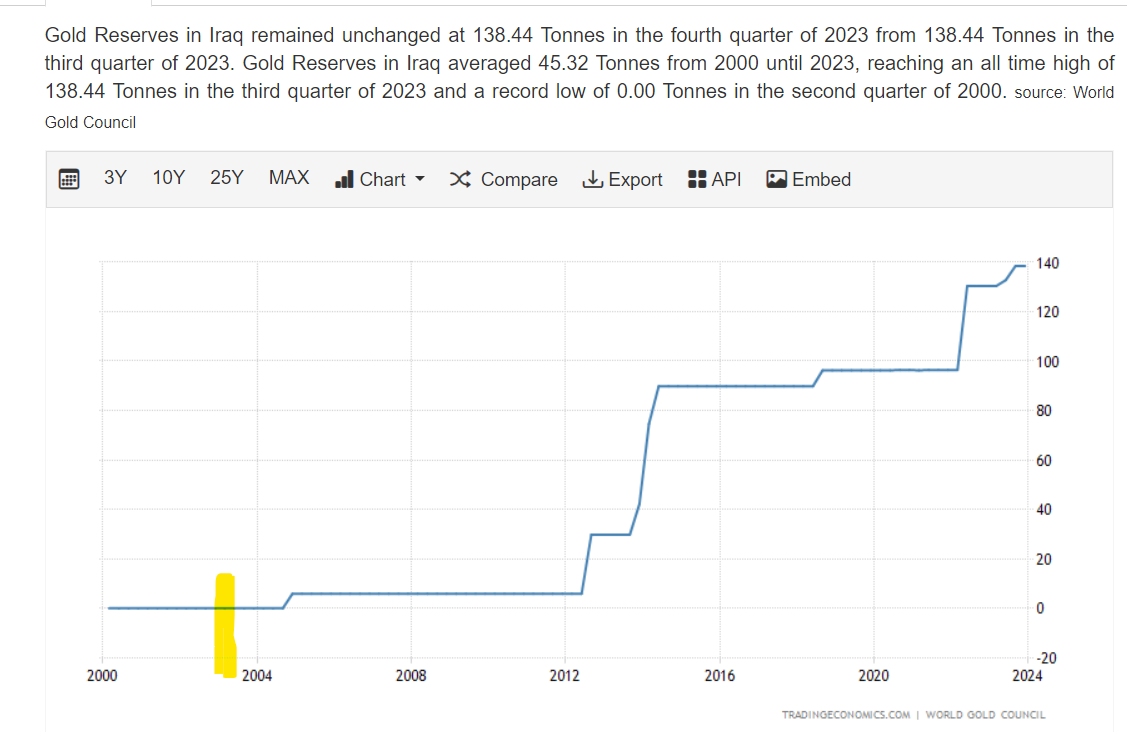

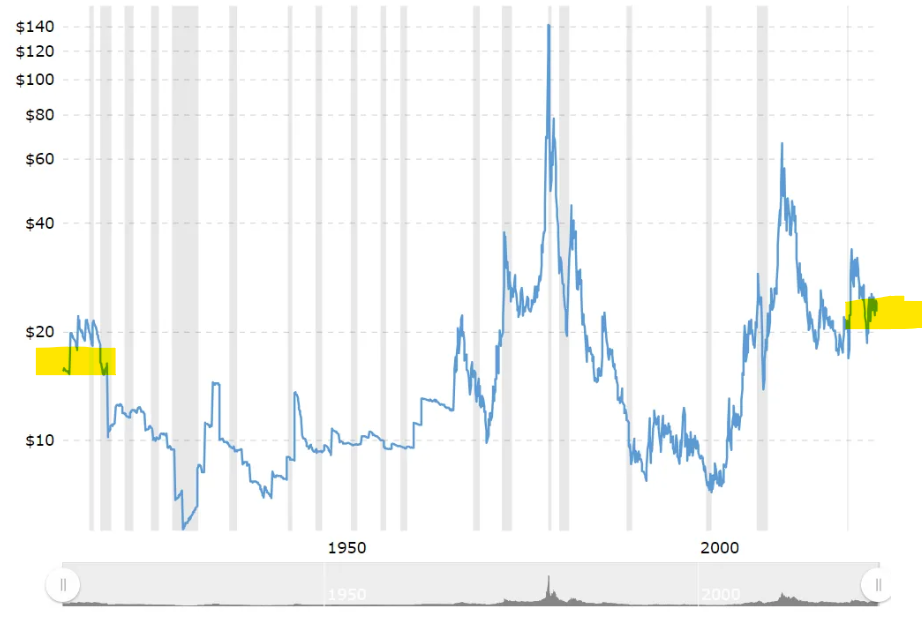

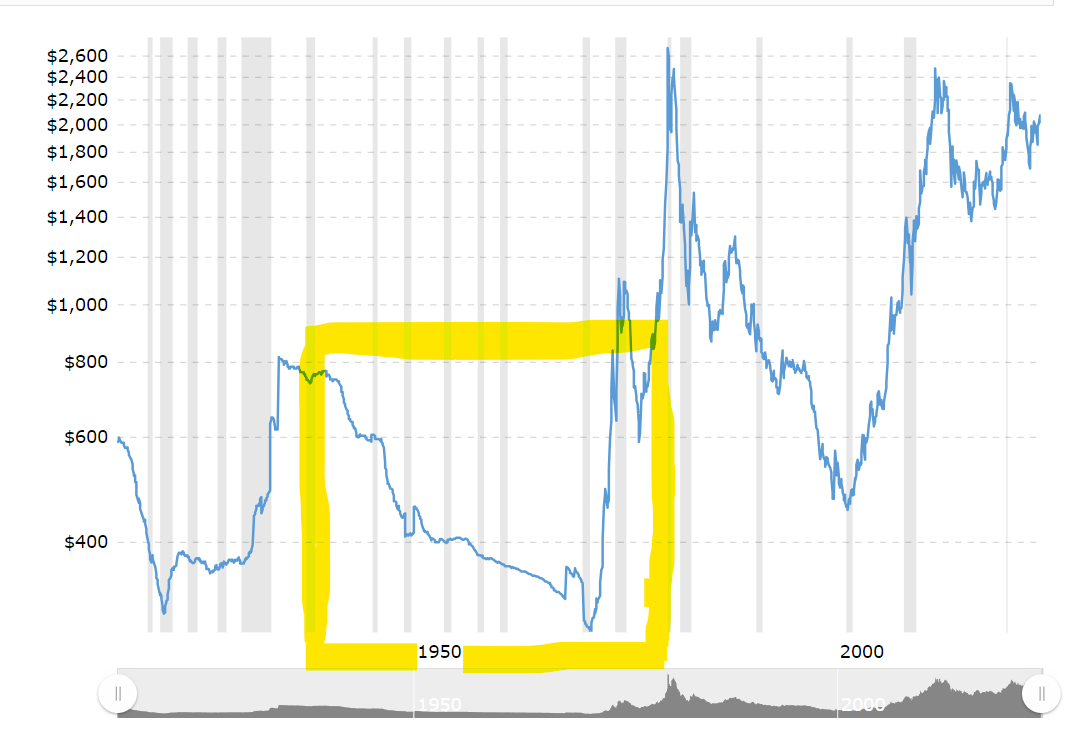

Wellll… it doesn’t look like that ever actually truly happened. Here’s a historical chart showing Iraq’s Gold Reserves. 2003, the alleged year of the confiscation, is shown by my ugly yellow line:

In fact, Iraq is currently the 28th highest country in terms of gold ownership. Iraq is about 1.6 times smaller than the state of Texas! Such a small country, conducting terrorism from holes in the desert, probably using blocks of gold as furniture. Gotta love history his-story.

Let’s get back to the timeline:

So, as the US prepared to invade Iraq, the price of gold reaches a six-year high of $367 an ounce….. yep. It’s a game for a secret club that you and I aren’t a part of. A game that we have zero control over and have to slave away in the system to buy into… the system THEY OWN!

PROBLEM #3: Scams, Scams, Scams…

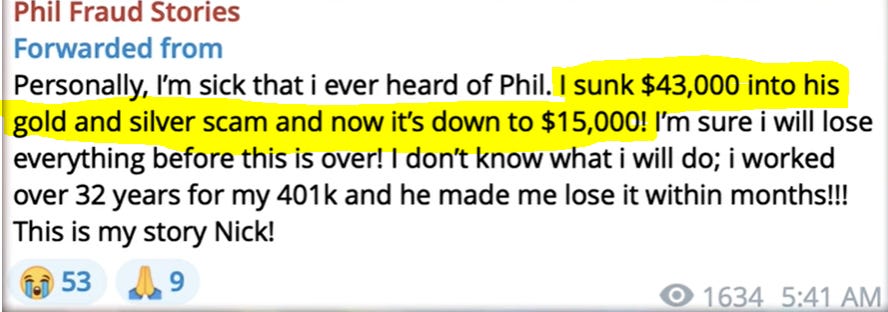

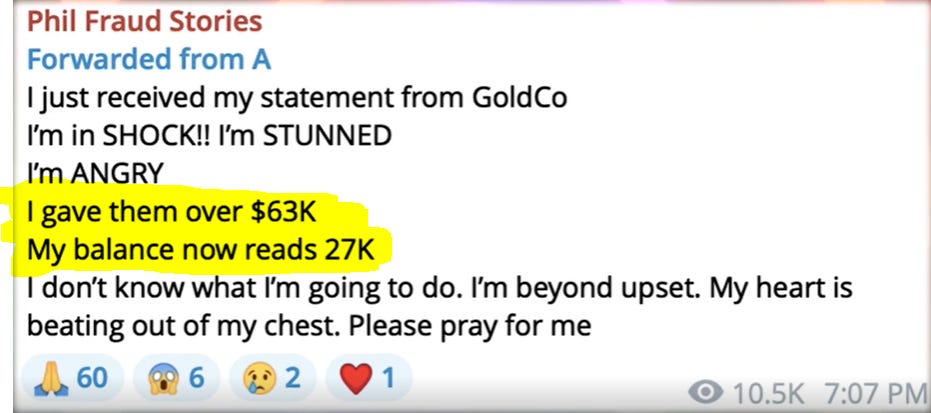

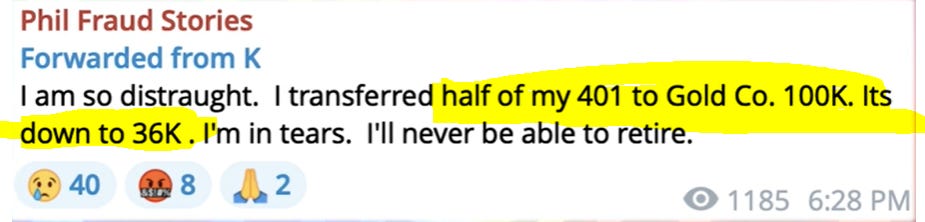

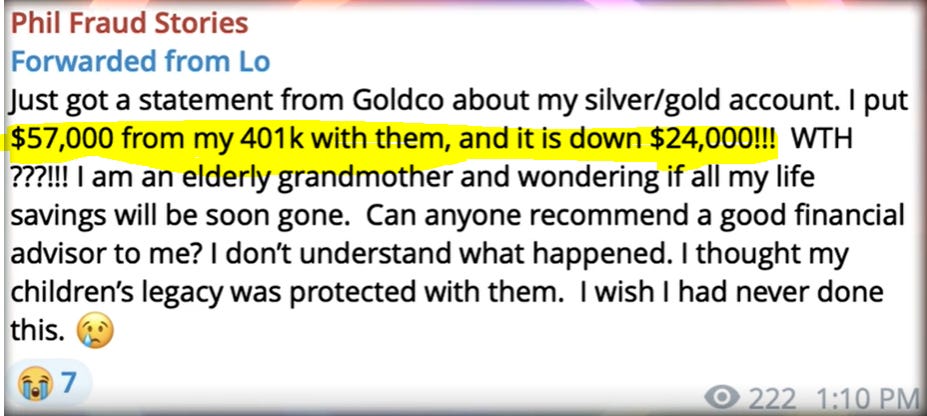

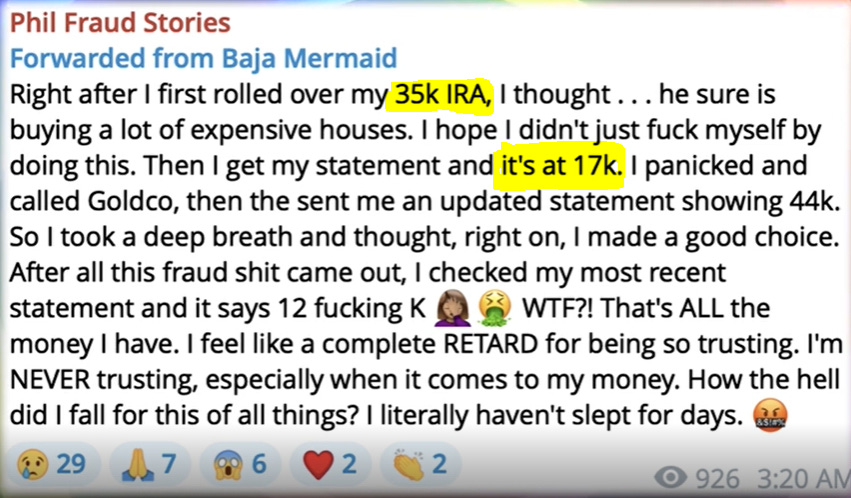

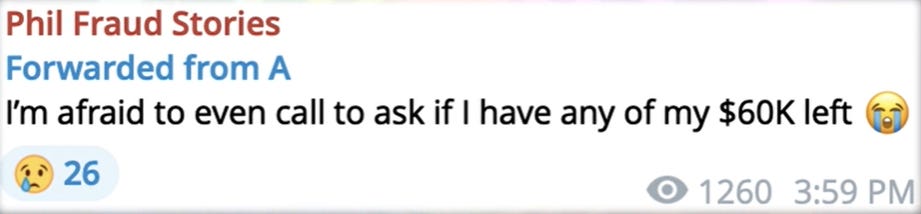

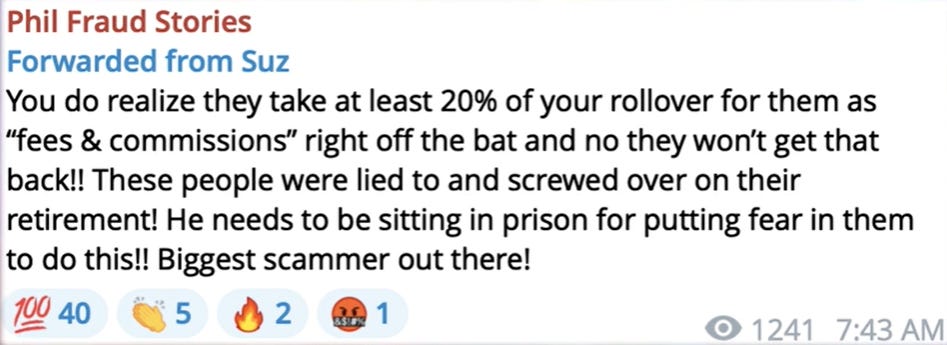

Unless the precious metal is in a safe in our bedrooms, we have 0 control over it. And who exactly are the companies that offer metal investments and / or storage? Like, has anyone truly did a deep dive into who these entities are? Is it like Vitamins and Supplements where if you dig deep enough, you discover that it all traces back to Big Pharma, Venture Capital Firms and The Royal Society (Eugenics)? I don’t know the answer to this because I have never truly looked into them, and neither did these people:

Screenshots from the new documentary The Greatest Fraud on Earth

Folks, I hear commercials on our alternative media stations telling people to put their entire retirement fund into their gold company and they will give you a $10,000 - $50,000 bonus. Does that seem scary to you based on what we have discussed thus far? If you want to read more about all investment scams, I found a great article called 15 Reasons to Not Invest in Gold. The article has been scrubbed from the internet (gee, I wonder why?) but I recalled it for you. You can read it here.

And while we are on the topic of “precious metals”, who determined they are precious? The people who own the mines! The people who own the game! The people who control the governments who decide if and when we can have it! I live in Michigan. My back yard is made of clay soil. If I was an elite could I say it’s “precious clay”, then run a massive PSYOP to get people to believe it and buy it from me? Maybe.

PROBLEM #5: TESLA, Amazon, Google, World Economic Forum and More…

This isn’t really a problem, it’s just a point of interest. All of these companies are hugely interested in mining… and yes, they have gold mines, but they don’t appear to be focused on mining for gold. They’re mining for graphite, nickel, lithium, copper, manganese, bauxite (aluminum) and cobalt, because, that is where they see the real value.

PROBLEM #6: Is this Really an Investment?

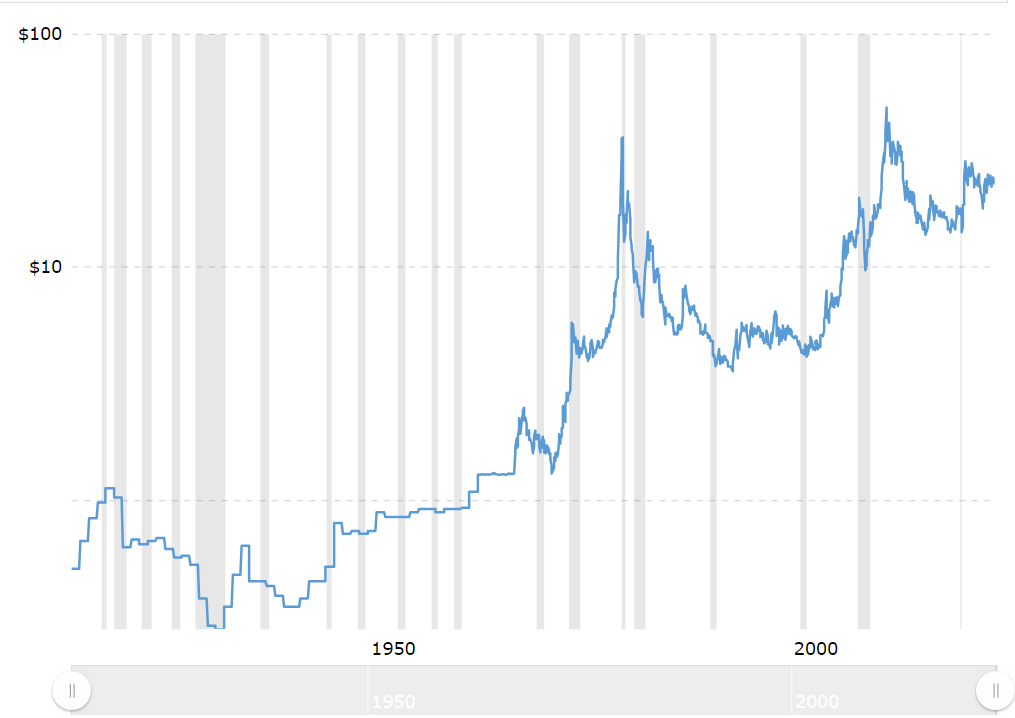

Here’s the price of silver history, which clearly shows it is a phenomenal investment, right?

Well, here’s the same history of the price of silver with adjustment for inflation (which is very important to look at). Silver is almost the same price today as it was in 1915! How is this a good investment?! Is there nothing more beneficial that we can put our money toward than this?

Meanwhile, I’m seeing people like Mike Adams, The Health Ranger (whom I like a lot) saying that silver is the way forward because it’s a great investment. I guess I am just not seeing the greatness. Does The Health Ranger know how the price of gold and silver is actually set?

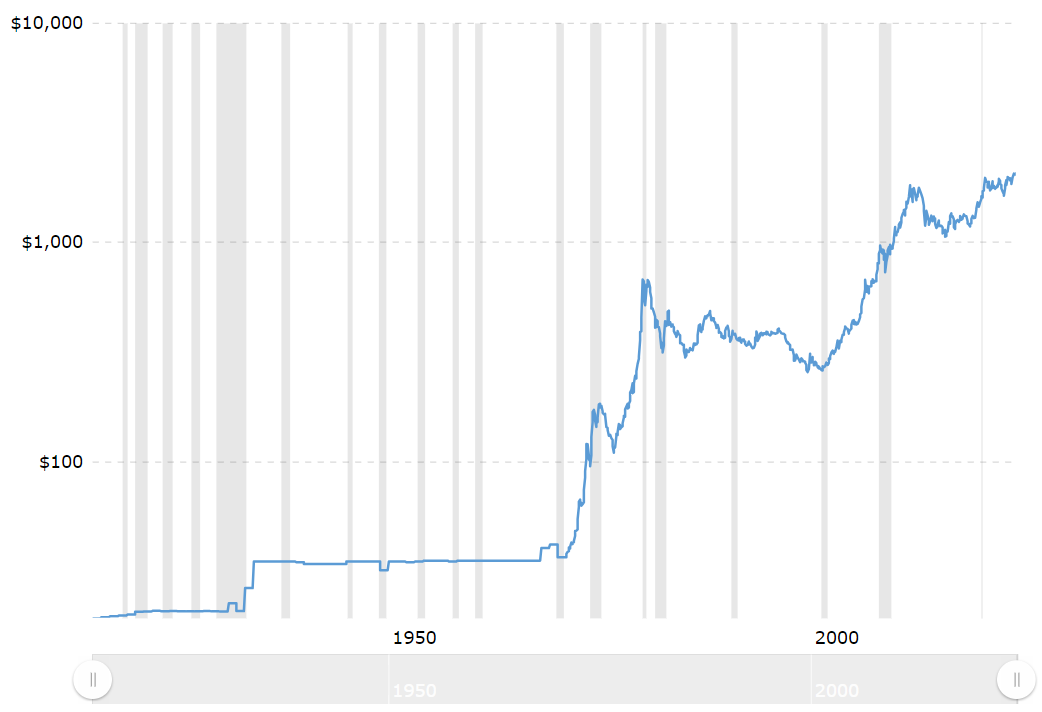

Oh, and gold is similar. If you look at the chart, without adjusting for inflation, you see an incredible investment opportunity, and this is what the media shows us:

But again, when you adjust for inflation, you get this, heart-monitor chart that looks like the stock market:

Why aren’t they showing us inflation-adjusted charts? Why doesn’t this precious metal go up in value during inflation, when gold jewelry, and everything else made from gold, is selling at inflated prices? How can the price of everything be at a historic high, yet gold is not when inflation-adjusted? We know why… we know exactly why…

I guess, if you have some kind of insider info (such as a cousin named Rothschild) and know when to buy-in, then you could buy-in in 1972 at $483, and in 1980 it’s worth $2,200, so that’s nice profit, but if you don’t jump to sell it, in 2001 it drops down to $472, which means you could have held your precious gold for nearly 30 years, to have it be worth less than when you purchased it back in 1972. In my opinion, this seems like a weird bank that you store your money in and it earns no interest, and you might lose all of your money. How does this benefit us? Again, is there nothing more valuable we could spend our money on?

PROBLEM #7: Did we even think this through?

In my opinion, this is probably the most important point, although you may disagree.

I don’t know about you, but I have spent the past 4 years heavily preparing for the worst case scenario, which I foresee beginning to rollout by, or in, 2030, per the 2030 Agenda, with the goal of full implementation by, or in, 2050.

As a typical dumb American with 0 survival skills, I have been trying to game plan how to protect my family and survive regardless of what they hit us with. It could be GeoEngineered storms that take out the power supply, knock out the internet and flood the streets. It could be an alleged “cyber attack” or some bullsh*t with the gas lines (in effort to force us into electric-everything). We already saw the chaos of 700+ “factory fires” in a single year and grocery stores with empty shelves and extreme “wildfires” popping up all over the world. They could hit us with anything, or multiple things from multiple angles because we are dealing with evil psychopaths.

So, I have been running through scenarios in my mind to try to find solutions to survival without electricity or a grocery store, or heat, or gasoline, or internet, or pick-something. Keep in mind, no internet is much more than missing out on the opportunity to scroll through Instagram. No internet = no credit card machines, no ATM, no access to banking, eCommerce is instantly gone; everything as we currently know it, is tied to the internet. This also means, if we are on 100% virtual currency, such as Bitcoin, we have no money, regardless of how much is in our virtual currency wallets. No NFTs either.

As I was walking through the no-internet scenario, with no access to money, I thought about gold and silver, which are supposed to be fail-safe methods to protect us financially, right? The theory is, even if paper currency becomes completely useless, or plummets in value, we have our metal safe with those gold bars hidden in the wall, behind the fake art, that we can whip out… but how would that work? Let’s gameplay worse-case-scenario:

Lets say we are not able to access our money due to no internet, but we have 100 silver coins, two kilos of silver and 2 bars of gold, how do we pay for a loaf of bread? Do we trade a $25 silver coin for the bread? Or do we ask for 10 loaves of bread so we get $25 worth of product? Or is the mom-and-pop-shop bakery, who also has no access to the internet, supposed to be able to make change for a $25 coin in silver? Is the bakery expected to hand us 1 loaf of bread and $23 in silver? Or are we supposed to find a way to get to a place that will trade our precious metal coins, bars and kilos for smaller dominations? And denominations of what? Bitcoin? NFTs? And wouldn’t this require internet?

And, regarding those of us who have our precious metals stored with a company, or have money tied up in precious metal investment funds, if sh*t hits the fan and the internet is out, how are we going to withdraw our nest egg?

On top of that, if sh*t hits the fan and we are stuck in a cashless society, where every transaction is monitored and reviewed, there is essentially no way to sell out secret silver coin stockpile hiding in the shoe box in the closet, without the government who wants us to own nothing being involved.

Another random thought: If the government was to Executive Order another seizure, wouldn’t they immediately go after all these precious metal sellers and storage places? And wouldn’t they seize receipts from all precious metal solicitors so they know exactly how much silver Agent131711 bought online? During the 1930s seizure they were arresting and jailing those who didn’t cooperate. Thought to self, “Is this what all those IRS new-hires are ultimately for?”

What exactly do IRS agents need guns for… seizing assets?

FINAL THOUGHTS

When the shows we listen to promote precious metals as being, “an amazing investment”, what exactly does this mean? What has precious metals investing done for Stew Peters? Or any of the shows advertising it? Does Mr. Peters know who sets the price for these metals? I’m not being condescending, I am asking a legitimate question because the shows never tell us how the financial investment became excellent for them, instead they tell us to buy, buy, buy and use their promo code so they get a kickback.

I’ll tell you what precious metals investing did for me: Both of my kilos of silver, which were my two biggest splurges, depreciated in value by over $100 each since I bought “invested” in them for myself my spouse, so there’s that… Again, I simply ask, are there other things that are more beneficial for us to put our money into?

Are “precious” metals just like “fossil” fuels? Just another made-up word to give something the elites control value? (thought to self: maybe I really am onto something with “precious clay”…)

I don’t know folks. I don’t have all the answers, but it sure seems like we are being encouraged to hand over our money to get coins, bars and bricks of a metal, in which the product is owned by the elites, the price is controlled by the elites and the government can take it away, make it illegal and tax the sh*t out of it. Additionally, it isn’t easy to use to pay for things. If the goal is for us to own nothing, and if precious metals truly are an amazing investment, why is all of the media, in unison, parroting that we should buy it now? Is this really a wise investment? I’m leaning toward no. In my opinion, commodities that can be utilized in the barter and trade system seems like a better investment. Want to know what I am instead investing in? Emergency food, blankets, solar lights, emergency water filters, sh*t like that.

I think I’m just going to leave it at that. It’s something for us to ponder. And, as always, if you are investing in something and it’s working for you, GREAT! Keep doing it! I am not trying to give advice to anyone, I’m just asking questions, which, as of now, is still legal.

And one more thing, allegedly, as of 2004 Rothschild was getting out of setting the prices of gold. I didn’t pursue this line of investigation because the game is rigged. It doesn’t matter who sets it now, I’m done playing.

If the Donate icons aren’t working for you, here’s the link to Kofi and here’s the link to Buy Me A Coffee. And a MASSIVE THANK YOU to those who have supported me! I sincerely appreciate it!

NEXT READ

SOURCES & OTHER STUFF

Here’s the full presentation the 11-second clip is from (1 hour): https://archive.org/details/GeorgeHunt-TheNewWorldBankReligionAndRulersOfTheWorld

https://munknee.com/noonan-rothschild-system-present-future-price-gold/

http://www.moonlightmint.com/bailout.htm

https://theconversation.com/how-the-us-government-seized-all-citizens-gold-in-1930s-138467

https://en.wikipedia.org/wiki/Executive_Order_6102

https://federalnewsnetwork.com/hiring-retention/2023/08/irs-hiring-its-way-to-900000-employee-workforce-for-first-time-in-decade/

https://www.learnliberty.org/blog/cashless-society-is-the-new-black/

https://www.weforum.org/agenda/2012/11/measurable-resilience-the-new-gold-standard/

https://www.weforum.org/agenda/2015/07/a-brief-history-of-gold/

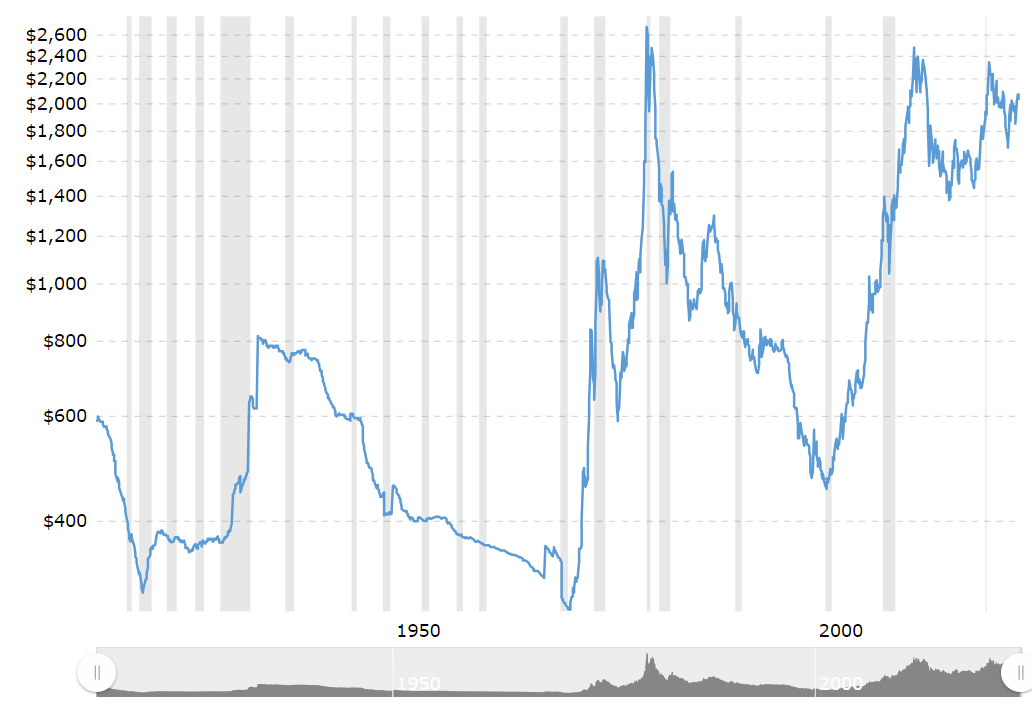

Here is the price of gold history. The yellow box is the approximate years it was made illegal to own in the USA. Note how as soon as the Executive Order was repealed in the 1970s, the price was shot up to nearly $2,600, then once people bought-in, it was smashed down to $480, then slowly shot up. The price still has not rebounded to the $2,600 it was in 1980, but it is almost at an all-time high price, which makes it illogical to buy-in now, yet they are pushing hard for it.

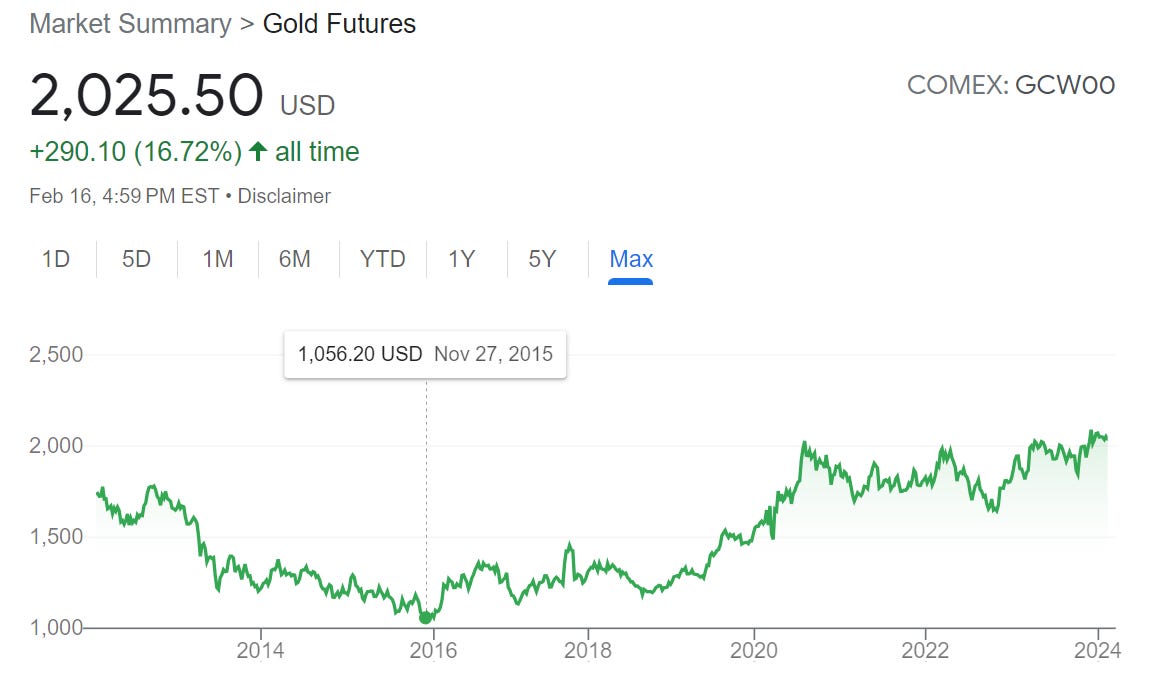

Here’s a closer look at the past 5 years:

Lets look at gold futures:

If you bought in on January 27th, 2012 you paid $1,735.

As of February 9th, 2024 it was at $2,038.

That’s $303 over 12 YEARS. Once you account for inflation, I don’t think you made a dime in profit. In my opinion, this doesn’t seem like an “investment”

If you bought in, in November 2015, when prices dropped down to $1,056, you’ve made $954 in 9 years, so that’s not bad, but if you hold it, you know it’s going to drop down again.

Subscribe to Agent131711’s Substack

I'm a researcher. Come explore uncomfortable Truths in a lighthearted way that makes them easier to digest (and sometimes even hilarious). I publish special deep dives for paid subs on the 1st and 15th, everything else is free.

Interesting post. Substitute BTC for Gold, and you might be on to something.

Gold is not an investment. It’s an insurance policy. Is it a good one? I don’t know. What I do know, is that for the average person (obviously my view) it’s a better option than anything else that exists. And has been for 1000s of years.

Viewing gold as an investment, particularly over short time frames, is an incorrect approach.

I’ll leave it at this: if you research the Roman Empire you will discover that when a man’s daughter got married, he was expected to buy and wear a new custom woolen Toga, draped over his everyday Tunic, to mark the solemnity of the occasion. The cost of that new woolen Toga, 1oz of gold. For a ‘working class’ Roman citizen, that might be a year or two of labor to save enough money to accumulate an Oz of gold.

Today, a moderately priced custom suit costs 1oz of gold.

Priced in Oz of gold, the median price of a house today, is the same as it was in 1975.

I’ll take my chances with the shiny metal, which has tracked the destruction of purchasing power of fiat currencies for 1000s of years.

I think when the shit hits the fan - we will enter a barter system based on individual assessments and not a gov. approved value system. We saw this in the great manufactured depression 0f 1929 and again in the created banking/housing crisis in 2008. A dentist I know exchanged his service for a gun and other things he needed. When my Dad was growing up during the depression, you could get medical care for a chicken - there was little money where he lived and stores accepted trade. If you were unable to pay but good for it was noted on the due bill or tab which could be paid off with cash or commodities or services. We can't anticipate all possible scenarios - but humans have been around longer than the bankers - their plan was written hundreds of years ago and adjusted where needed. It was and is guided by Satan and installed with fear and control- ours has to be guided by God and carried out with faith, wisdom, and discernment. Discerning truth from lies and the intent of what we are being told is vital to survival. We may not have the answers - but unless we ask the questions and try to understand things instead of just accepting what we are told or things we find it convenient to believe, we will continue to be complicit in their plan, IMHO.